The Fonds Stratégique des Transitions (FST)

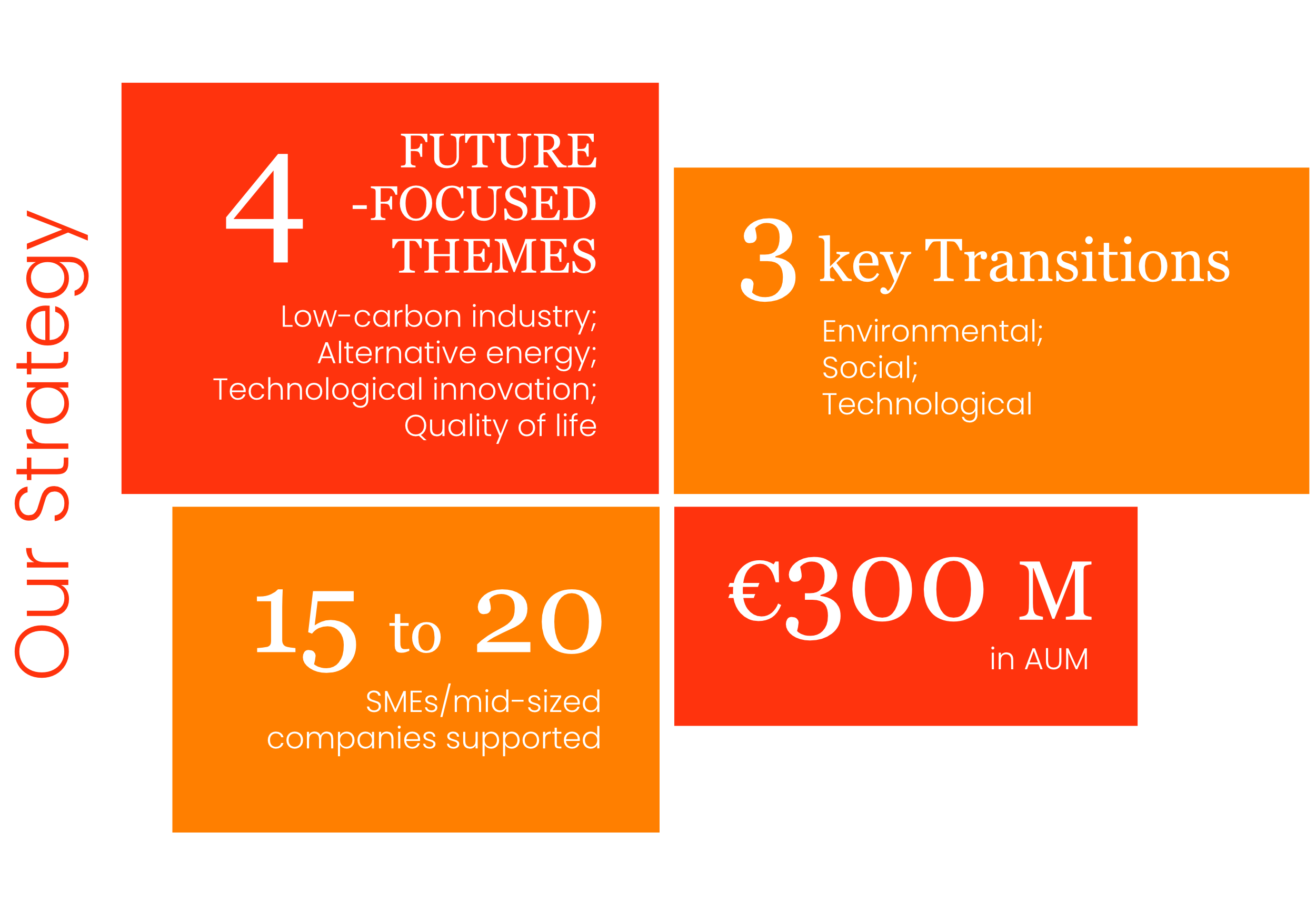

The FST is a long-term investment vehicle designed to support the industrial scale-up of innovative French SMEs and mid-sized companies with a clear vision of tomorrow’s societal needs.

Financing Innovation-Driven SMEs and Mid-Sized Companies

The Fonds Stratégique des Transitions (FST) supports French innovative SMEs and mid-sized companies in their growth and transition projects.

Focusing mainly on companies with advanced and robust technologies, ISALT, as a long-term investor, helps these companies scale industrially by financing production capacity while ensuring environmental, technological, and social transitions remain central to their strategic priorities.

In practical terms, we help companies establish local operations, build factories, strengthen teams, and form their first industrial and commercial partnerships.

The companies we select share a common DNA: innovation, technology, and decarbonization.

Championing the New French Industrial Model

ISALT is optimistic about the future of French industry and actively contributes to its renewal by supporting the creation and growth of high-potential, innovative businesses and services. Our goal is to help build a competitive and resilient “new industry” in France—one capable of standing alongside Europe’s and the world’s best.

The FST is built on four core beliefs:

➔ France has many strengths to spark economic and industrial renewal, generating growth beneficial for future generations

➔ Supporting innovative and technology-driven SMEs and mid-sized companies is crucial for this industrial renaissance

➔ These companies are key drivers of competitiveness and economic growth. Long-term capital is critical to support the investments they need to scale

➔ Investing long-term means financing innovation and expanding production capacity. It’s a civic commitment to strengthening productive investment and regional expertise

Targeted Sectors

The FST aims to support around twenty innovative SMEs and mid-sized companies in four strategic sectors for the French economy:

➔ Alternative energies: energy production and distribution, electrification, and energy efficiency

➔ Low-carbon industry: circular economy and sustainable production

➔ Quality of life: health, food, and responsible agriculture

➔ Technological innovation: critical components, production automation, security, and digital services

“We will help French companies take a step forward by directly financing their development projects and production capacities. We firmly believe these industrial initiatives will deliver high-value products to clearly identified and growing end markets.”

– Nicolas Dubourg, President of ISALT

Decarbonization as a Priority

ISALT acts for a low-carbon economy. Our fund prioritizes supporting the reduction of greenhouse gas (GHG) emissions to combat climate change.

We help companies define and implement a decarbonization trajectory aligned with the Paris Agreement climate goals. Our aim is to raise awareness among companies and their leaders regarding emission reductions across their value chains. With over 10 years of experience in decarbonization, we share best practices, provide tools and expertise, and help deploy ambitious yet realistic carbon reduction strategies.

Portfolio Companies

Sources

Founded in 2000, Sources specializes in the design and construction of turnkey water treatment plants. An independent sector leader, Sources serves municipalities and industrial clients across France and internationally, with over 500 plants built and 14 regional offices. The company offers a wide range of solutions, from wastewater treatment to potable water production, industrial water treatment, waste management, and associated services. Sources integrates advanced technologies such as co-methanization of sludge, Carbocycle® processes, and energy recovery from waste. The FST’s LBO will strengthen Sources’ growth, expand its regional presence, and consolidate its position among the leading water treatment companies in France and Europe, in a context where sustainable resource management is a major strategic challenge.

Entry date: June 2025

Via Sana

Founded in 2020, Via Sana specializes in turnkey clinics for healthcare professionals. A market leader in France, its network includes 450 clinics across 50 sites in major cities. Each month, more than 500 healthcare professionals welcome nearly 30,000 patients. The FST investment will help Via Sana strengthen its model and accelerate development by consolidating its position in the liberal healthcare market across France, enhancing its digital platform, and making local healthcare more accessible.

Entry date: April 2025

Epsor

Founded in 2017, Epsor is a French fintech transforming employee savings and retirement plans into an HR lever for companies. Through an intuitive digital platform, personalized human support, and an independent investment offering, Epsor manages savings plans (PEE, PER, PERECO…) for over 1,500 client companies and supports more than 200,000 employees. With +50% growth in 2024 and the ambition to triple assets under management by 2027, Epsor welcomed the FST as an investor in March 2025 through a €16M Series C round. Epsor is the only fintech in the sector certified B Corp.

Entry date: March 2025

Energies de Loire

Founded in 2018, Energies de Loire develops, builds, and operates photovoltaic plants in Pays de la Loire and Brittany with an innovative zero-land-use approach. With 600 plants already built totaling 100 MW and a target of 800 MW by 2030, the company aims to become a regional photovoltaic leader supporting agricultural, industrial, and municipal stakeholders.

Entry date: December 2024

Unseenlabs

Unseenlabs is the world’s leading provider of radio-frequency (RF) data and solutions for maritime surveillance. Its proprietary technology allows precise geolocation and characterization of any ship globally under all weather conditions. The FST’s participation in Unseenlabs’ exceptional fundraising—one of the largest in the space sector—demonstrates ISALT’s interest in disruptive technologies. With 11 satellites already deployed and 10 more planned by 2025, Unseenlabs’ technology is transforming maritime surveillance.

Entry date: February 2024

Intact Regenerative

Intact is an innovative industrial and tech company producing low-carbon ingredients, pioneering a new regenerative agriculture-based French food sector. Founded in 2022, Intact produces a new generation of high-quality plant proteins from legumes and a neutral alcohol for food, cosmetic, and pharmaceutical uses. The FST investment enables the construction of its first industrial site in Baule (Loiret), operational in 2024.

Entry date: September 2023

Tissium

Founded in 2013, Tissium is a French medtech company developing polymers for atraumatic tissue reconstruction during surgery. Its solutions offer non-traumatic alternatives to staples and invasive screws in peripheral nerve, hernia, and cardiovascular surgeries. Tissium has 62 patents and operates in Paris and Boston. The FST’s participation will support scaling and U.S. commercialization over the next five years.

Entry date: May 2023