The Fonds Stratégique de Participations

The FSP is a long-term investment vehicle whose shareholders and board members consist of seven major French insurance companies: BNP Paribas Cardif, BPCE Assurances, CNP Assurances, Crédit Agricole Assurances, Groupama, Société Générale Assurances, and Suravenir.

The Fonds Stratégique de Participations provides sustainable support to French companies as they pursue growth and transition projects. The fund takes significant “strategic” equity stakes in companies and actively participates in governance by sitting on boards of directors or supervisory boards.

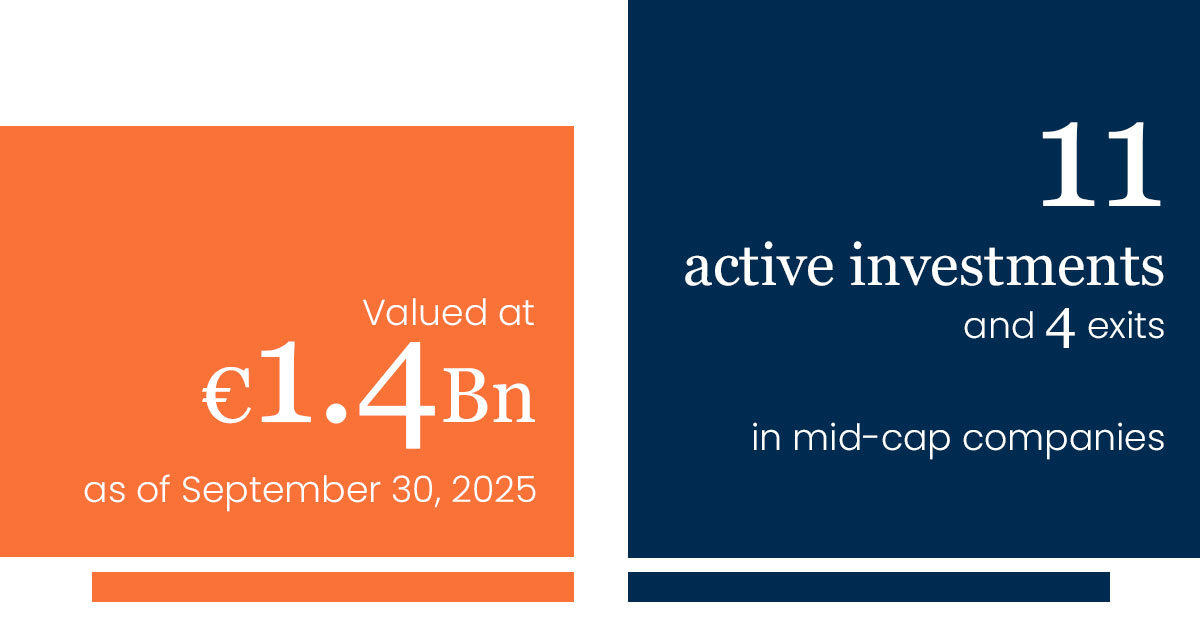

As of September 30, 2024, the FSP portfolio included 10 stakes in leading French companies in their respective fields: SEB, Arkema, Eutelsat Communications, Tikehau Capital, Elior, Neoen, Valeo, Soitec, Verkor, and an anchor investment in the Fonds Stratégique des Transitions (FST).

Previously, the FSP played a key role in the successful merger of Zodiac and Safran, creating the world’s second-largest aerospace equipment manufacturer. In November 2022, the FSP exited its position in Safran, generating over €350 million.

The FSP is one of the few private funds in France capable of deploying significant amounts (on average €250 million per operation) with a long-term horizon.

Renaud Dumora, representing BNP Paribas, has been the FSP’s chairman since April 26, 2024. The Strategic Participation Fund is an alternative investment fund designed for professional investors and has been declared to the French Financial Markets Authority (AMF).

A Responsible and Committed Shareholder Approach

In line with its long-term investment philosophy, the FSP maintains ongoing, constructive dialogue with portfolio companies and consistently exercises its voting rights at shareholder meetings. As a reference shareholder and board member, the FSP goes beyond traditional ESG strategies to actively shape corporate governance and strategic direction.

The FSP offers multiple benefits to its shareholders: a specialized, pooled investment vehicle for acquiring equity stakes in French companies; favorable regulatory treatment under Solvency II for strategic holdings, a channel for directing long-term savings towards companies driving essential economic transitions.

Insurance Company Shareholders of the FSP

Since its founding in 2013, the FSP’s insurance shareholders have pioneered a collaborative approach to strategic investment in listed French mid-cap companies.

Each insurer determines its investment amount per transaction based on its own portfolio allocation. The average investment per company is €250 million, allowing the FSP to hold between 4% and 10% of the capital.

The insurance companies also sit on the FSP’s Board of Directors and actively shape its strategic direction, investment policy, and decisions affecting portfolio companies.

FSP Board Members:

Renaud Dumora, Deputy CEO of BNP Paribas and Chairman of the FSP

Julien Carmona, Chairman of Crédit Mutuel ARKEA, representing Suravenir

Corinne Cipière, CEO of BPCE Assurances

Nicolas Denis, CEO of Crédit Agricole Assurances

Marie-Aude Thépaut, CEO of CNP Assurances

Thierry Martel, CEO of Groupama

Philippe Perret, CEO of Société Générale Assurances

Portfolio Companies

Groupe ADIT

Founded in 1993, Groupe ADIT is the European leader in strategic intelligence and operational support internationally. Present in over 130 countries, ADIT supports 1,200+ clients—including businesses, investment funds, and public institutions—in risk management, economic security, compliance, public affairs, and cybersecurity. With 2,000+ employees and a projected consolidated revenue of €525 million in 2025 (60% international), ADIT has become a key partner for French and European economic sovereignty. The FSP invested in July 2025 to support its growth and strategic role amid evolving geopolitical challenges.

Entry date: July 2025

Robertet

Founded in 1850 in Grasse by the Maubert family, Robertet is a global leader in natural raw materials for perfumes and flavors. The company controls the full value chain from ingredients to finished products for beauty, health, and food markets. Robertet is committed to innovation and sustainability, continually exploring new natural sources globally. Revenue in 2023 exceeded €720 million, with 80% generated internationally.

Entry date: November 2024

Stake: 7.59% Capital / 3.75% Voting Rights

Board Representative: Guy Talbourdet

Verkor

Verkor, a future French leader in electric mobility, designs and manufactures low-carbon, high-performance batteries for the European automotive market. Founded in July 2020 in Grenoble, Verkor launched a fully digital 4.0 pilot line in 2022, integrated into its planned 2024 Gigafactory. The FSP invested as part of Verkor’s €850M Series C, complemented by French and European grants. This record €2B+ funding enables the construction of its first gigafactory in Dunkirk, in the “French Battery Valley,” supporting the fast-growing EV market.

Entry date: September 2023

Fonds Stratégique des Transitions

The FST is a long-term investment vehicle managed by ISALT, designed to support the industrial scale-up of innovative French SMEs and mid-sized companies. Focusing on businesses with advanced and resilient technologies, the FST helps companies expand their production capacity while ensuring that environmental, technological, and social transitions remain central to their strategy.

Entry date: March 2023

Soitec

Soitec is a global leader in the production of innovative semiconductor materials. With over 3,500 patents and 2,000 employees, the company leverages proprietary technologies to serve the electronics market, delivering products that combine performance, energy efficiency, and competitiveness.

Entry date: 2022

Stake: 2.48% Capital / 3.87% Voting Rights

Board Representative: Laurence Delpy

Believe

Believe is a global leader in digital music. Its mission is to support independent artists and labels through tailored digital solutions at every stage of their development. With 1,270 employees across 50 countries, Believe combines technological platforms and digital expertise to promote and distribute music worldwide.

Entry date: 2021

Exit date: 2024

Valeo

Valeo is a global automotive supplier and technology partner to manufacturers worldwide. It develops innovative systems and equipment that reduce CO₂ emissions and enable intuitive driving. In 2021, Valeo generated €17.3 billion in revenue, dedicating 9.5% to R&D. As of June 30, 2021, the company employed 104,000 people across 33 countries, with 184 production sites, 20 research centers, 42 development centers, and 15 distribution platforms. Valeo is listed on the Paris Stock Exchange.

Entry date: 2019/2020

Stake: 4.17% Capital / 7.43% Voting Rights

Board Representative: Julie Avrane

Neoen

Neoen is one of the world’s leading and fastest-growing independent producers of exclusively renewable energy. It operates nearly 4.8 GW of solar, wind, and storage capacity in operation or under construction across Australia, France, Finland, Mexico, El Salvador, Argentina, Ireland, Jamaica, Mozambique, Portugal, and Zambia. Neoen also has a presence in Croatia, Ecuador, the United States, and Sweden. It developed and operates France’s largest solar farm in Cestas (300 MWc) and the world’s first large-scale battery storage facility in Hornsdale, Australia (150 MW / 193.5 MWh). Neoen aims to reach at least 10 GW of capacity in operation or under construction by the end of 2025.

Entry date: 2018

Exit date: 2024

Elior

Founded in 1991, Elior Group is a global leader in contract catering and services, serving corporate, education, healthcare, and leisure sectors. Operating in six countries, Elior generated nearly €4 billion in revenue in 2020. Its 105,000 employees serve over 5 million people daily across 23,500 restaurants on three continents and provide services at 2,300 sites in France. The group’s business model is built around innovation and social responsibility.

Entry date: 2018

Exit date: 2025

Tikehau Capital

Tikehau Capital is a global alternative asset management group with €30.9 billion in assets under management (as of June 30, 2021). It offers a broad range of expertise across four asset classes: private debt, real assets, private equity, and capital markets strategies, along with multi-asset and special situations strategies. Led by its co-founders, Tikehau Capital operates with a differentiated business model, a strong balance sheet, privileged access to global deal flow, and deep experience in supporting high-quality companies and leadership teams. Its entrepreneurial spirit is shared by its 629 employees across 12 offices in Europe, Asia, and North America.

Entry date: 2017

Stake: 6.91% Capital / 6.91% Voting Rights

Board Representative: Florence Lustman

Eutelsat Communications

Founded in 1977, Eutelsat Communications is one of the world’s largest satellite operators. With a global fleet and ground infrastructure, Eutelsat enables clients in video broadcasting, data services, government communications, and fixed/mobile connectivity to reach their audiences worldwide. The company broadcasts over 6,800 channels operated by major media groups, reaching an audience of one billion viewers via satellite and terrestrial networks. Headquartered in Paris, Eutelsat operates through a global network of offices and teleports. Its 1,200 employees from 50 countries are committed to delivering top-tier service quality.

Entry date: 2016

Stake: 4.15% Capital / 4.15% Voting Rights

Board Representative: Agnès Audier

Safran

Safran is a global high-tech group operating in aerospace (propulsion, equipment, and interiors), space, and defense. Its mission is to contribute sustainably to a safer world, where air travel becomes more environmentally friendly, comfortable, and accessible. Present on every continent, Safran employs 76,000 people and generated €16.5 billion in revenue in 2020. The group holds leading global or European positions in its markets, either independently or through partnerships. Safran is deeply committed to R&D programs that align with the environmental priorities of its innovation roadmap.

Entry date: 2015 (initial investment in Zodiac Aerospace, 2018 takeover of Zodiac by Safran)

Exit date: 2022

Arkema

With unique expertise in materials science, Arkema offers a portfolio of cutting-edge technologies to meet the growing demand for new and sustainable materials. The group provides advanced technological solutions addressing challenges in new energy, water access, recycling, urbanization, and mobility. Arkema generated approximately €8 billion in revenue in 2020 and operates in nearly 55 countries with 20,600 employees.

Entry date: 2013

Stake: 7.82% Capital / 12.50% Voting Rights

Board Representative: Isabelle Boccon-Gibod

Groupe SEB

Groupe SEB is a global leader in small domestic appliances, operating through a portfolio of 31 iconic brands (including Tefal, Seb, Rowenta, Moulinex, Krups, Lagostina, All-Clad, WMF, Emsa, Supor), distributed across multiple retail formats. Selling over 360 million products annually, the group pursues a long-term strategy focused on innovation, international expansion, competitiveness, and customer service. Present in 150 countries, Groupe SEB generated €8 billion in revenue in 2021 and employs more than 33,000 people.

Entry date: 2013

Stake: 4.74% Capital / 6.52% Voting Rights

Board Representative: Catherine Pourre